Nova Scotia and Ontario rank as the two most expensive provinces to get an education. Costs are expected to grow by 39% over the next 18 years, leaving many to pay over $100,000 for a four-year degree and residence.

To shed light on the road ahead, we’ve released a forecast of how much an average four-year university degree will cost Canadian students in each province.

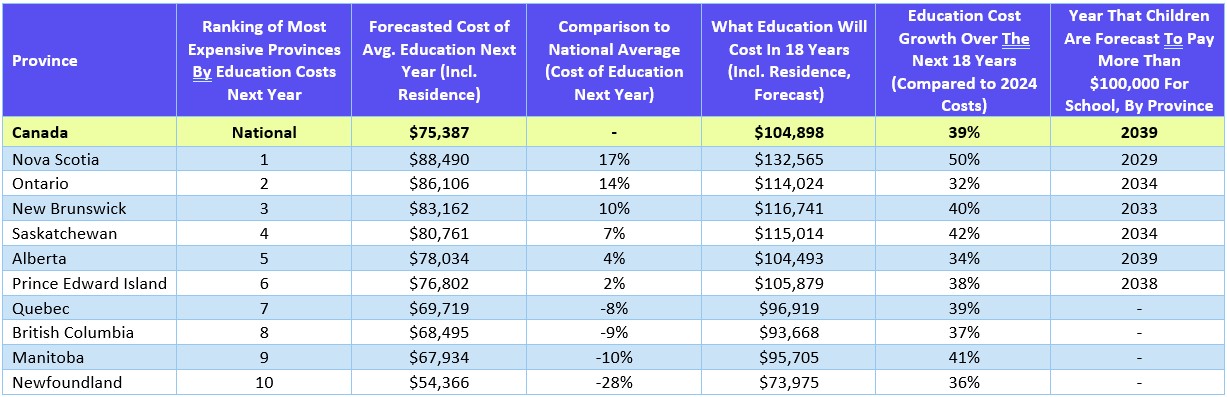

Next year, the average cost of a four-year post-secondary program in Canada will rise to just over $75,000 when factoring in residence costs. This figure is forecast to rise by 39 per cent over the next 18-years, reaching $104,898 by 2041.

For Canadian parents raising generation alpha, this means that they’ll soon be planning and saving for a six-figure education. In fact, children in certain provinces will reach this mark far sooner, with those in Nova Scotia, Ontario, New Brunswick and Saskatchewan estimated to pay over $100,000 for school within the next 11 years.

When looking at the forecasted cost of a 4-year degree and residence for students starting school next year, Canadians in these four provinces are also expected to pay the most, with those in Nova Scotia and Ontario having to pay an average of $88,490 and $86,106, respectively. This is more than $10,000 greater than the national average. On the other end, students in British Columbia ($68,495), Manitoba ($67,934) and Newfoundland ($54,366) are estimated to pay the least.

Cost of a Four-Year University Degree Per Province [1]

Click here for a PDF version of the table found above.

The chart above is ranked from the most to least expensive province for an average four-year university degree and residence. It also projects how much the same education will cost in 18 years, as well as the year that a four-year university degree is expected to exceed $100,000 for each province.

“Post-secondary education is one of the most substantial investments Canadians can make towards their future, but it can also lead to a distressing financial burden,” said Andrew Lo, CEO and President of Embark. “Given that the cost of education has historically outpaced inflation, it is vital for parents and students to not underestimate the associated expenses, and proactively plan for savings at the earliest opportunity to avoid sticker shock when the time comes.”

When asked, 31 per cent of Canadian parents did not know enough to even guess how much an education now costs. When parents did guess, they believed a four-year program cost $62,067 when factoring in all expenses, which is below the estimated average cost for 2024 in nine of the ten provinces – and over $10,000 off from the national average.

What’s more, many Canadian families are leaving government grant money on the table. The Canada Education Savings Grant (CESG) matches 20% of what you contribute to an RESP every year, giving you up to an additional $500 in savings annually and up to $7,200 over the lifetime of your plan. Another grant, called the Canada Learning Bond (CLB), offers families with modest incomes money for just opening an account – no contributions are required to receive it if you fall within the eligible income requirements. One of the best things about the CLB grant is that it can be received retroactively, as long as you apply.

“In order to maximize education savings, it’s important to leave no stone unturned. We saw that less than half of parents know about the CESG, which means most Canadians are missing out on government money that they are entitled to,” said Lo. “At Embark, we have a strong commitment to ensuring that every possible opportunity and advantage is utilized to assist Canadians in saving for their education. Our unwavering focus is on optimizing education savings and empowering students to achieve their goals without the burden of overwhelming debt.”

Tips for Success when Saving in an RESP.

Embrace the power of time: Starting your savings journey at any age is possible, but the sooner you begin, the more time your money has to grow and flourish. Consider placing your funds in a tax-sheltered savings account, such as an RESP, to benefit from compounding growth. To get an estimate of your potential savings growth, explore our online calculator.

A practical savings strategy, is the best savings strategy: A feasible savings plan is essential for families. Don’t go into debt while preparing for your child’s education. Even small, consistent contributions can add up significantly over time. For example, if both parents start contributing $50 per month to an RESP when their child is born, they could accumulate approximately $37,000 by the time their child turns 18[2], when accounting for grants and a 4 percent rate of return.

It takes a village: While times are tough, funding your child’s education savings does not have to fall completely on your shoulders. For instance, the government will boost your contributions through grants, giving you an extra 20 per cent in savings on your first $36,000 contributed, if saved correctly. Beyond grants, using gifted money from birthdays, Christmas, or other special occasions are a great way to add funds to your child’s RESP.

Save proactively and strategically: When asked, 68 per cent of students said they wish that they saved more before going to school. Students should talk to their parents early to see if they will help pay for their education and understand how much will be needed. While it may not seem fun at the time, it will help in the long run to try and save independently. In high school, try putting a portion of a part-time or summer job pay cheque away as education savings. An automatic contribution can make it even simpler and will ensure a certain amount is put away regularly.

For parents, if you want to help your child pay for their education, plan out your savings as soon as possible. Even if it does not seem like you have a lot to save, the more time your money has to grow, the better. Setting up a Registered Education Savings Plan (RESP) is a great way to do this, as you can get an extra boost from the government for contributing.

A little guidance goes a long way: 73 per cent of students wish they had more guidance when planning their post-secondary education. Take time to truly think about what you want to do and talk to people about it. Talk to guidance counselors and experts to learn more about different career paths, whether that is university or a trade school. You can also try to ask someone who is in that field for firsthand insight.

To learn more about how Embark can help parents save more, go to www.embark.ca.

[1] The forecasted figures found within this table are estimates based on data published by the Employment and Social Development Canada’s (ESDC) Canadian Post-Secondary Institution Collection (CPIC) database. This information, including tuition fees, are updated by the ESDC on an annual basis and are subject to change.

[2] This projection is based on assumptions and is for illustrative purposes only. Investment returns and actual future value of your RESP cannot be predicted or guaranteed.

Embark is Canada’s education savings and planning company. The organization aims to help families and students along their post-secondary journeys, giving them innovative tools and advice to take hold of their bright futures and succeed.